© 2006 - 2023 brand-newhomes.co.uk - All rights reserved

New Home News 2011

9 March 2011

Property fraud on the increase - Land Registry compensation up 25%

The Land Registry paid out a total of £4.9 million last year to compensate victims of property fraud – a 25% increase on the total paid out in 2008. Anyone can now gain access to property Title Deeds and plans for a £19.95 fee and can find out who owns a property for a similar fee. A complete history of a property is also available for an additional £14.95.

Fraudsters are using the Land Registry website to obtain mortgage account details and owner’s signatures. They can then use this information to create false identities and impersonate property owners, taking out new mortgages and even selling the property without the real owner’s knowledge. Last year, this type of fraud involved property worth around £20 million.

7 March 2011

NHBC launches new Fire Safety in Construction Course.

The new one-day course has been created in response to the Health and Safety Executive HSG-168, reflecting best practice in fire risk management.

It will benefit Project Managers, Site Managers and site supervisors involved in the day to day management of fire safety on site. Offering guidance on practical measures, the necessary precautions and requirements including:- hot works permits, storage of flammable materials, risk assessments of sub contractors; waste management, arson and high-risk sites such as timber frame.

3 March 2011

Falling house prices trapping second-time buyers in their homes

The Bank of England reports that new mortgage lending reached a record low in 2010. House prices have fallen 13% since the peak in 2007. This has hit first-time buyers who bought between 2006 and 2008 who now would like to move for work or personal reasons but are trapped because their deposit equity has been wiped out by falling house prices. Most lenders are requiring deposits of up to 20% for their better rates.

Overall 12% of homeowners currently have less than 10% equity in their home. The latest research by Lloyds suggests that nearly 20% of potential second-time buyers have less than 10% equity.

A sustainable housing market requires a complete chain and this latest research suggests that second-time, as well as first-time buyers are unable to enter the market due to mortgage availability and affordability.

2 March 2011

Lenders accused of pricing first-time buyers out of the market.

There is growing suspicion that the major banks are offering loans at rates set so high that first time buyers do not even apply. The latest “deals” are being priced in such a way there is little take up.

For example RBS is promoting a five-year fixed-rate of 6.39%, that rate is over 12 times the Bank of England current 0.5% base rate. This is specifically targeted at first-time buyers with a 10% deposit. Just 3 years ago, when the base rate was 5.75%, RBS five-year rate was 6.35% for borrowers with a 5% deposit.

A recent survey by Financial Mail comparing fixed-rate deals available in 2007 with those on offer today, found that RBS has increased its margin by more than ten times. RBS commented that first-time buyers accounted for 25% of its 2010 lending.

28 February 2011

New home starts down 8% compared to 2010.

NHBC data to the end of February 2011 indicate that there were 19,100 new homes started in the UK between December 2010 and February 2011 - an 8% decrease compared to the same period last year. Data over a 12 month period show that there were 105,450 starts in the UK (compared to 88,000 for the previous 12 months)

17 February 2011

Welsh Assembly votes for sprinklers in new homes

On 16 February 2011, the Welsh Assembly voted to make it mandatory to install sprinkler systems in all new homes. No date has been indicated, but the Domestic Fire Safety (Wales) Measure goes before the Privy Council on 7 April 2011 for final approval.

4th February 2011

The latest house price data shows that prices fell by 0.1% in January, with prices 1.1% lower than at the same time last year and 13% below the peak in November 2007.

If you adjust for inflation, house prices are down 20% in real terms since the crash and 5% during last year alone.

Mortgage lending in 2010 was £8.15bn, down from £11.3bn in 2009, the lowest level of lending since the Bank of England’s records began.

Most “experts” predict that house prices will be remain at present levels is now a best case scenario, with another major fall could be on the cards.

Home owners have been hit with a tripple wammy, wages falling by 3% a year in real terms, tax rises and benefit cuts along with the likely prospect of interest rate rises to stem rising inflation. Some home owners may be forced to sell up at any price they can get, driving the market lower.

17 January 2011

Water companies to be responsible for household pipework

There is political pressure for water companies to take responsibility for the supply pipe to the home in addition to the water main network. At present, water companies are only responsible for the mains and stopcock outside the property boundary. Any other mains, including the underground pipe from the stopcock to the home is the homeowner’s responsibility. Indeed, many water companies promote or offer a relatively expensive “Water Supply Pipe Cover” against any problems with the underground pipe.

During the recent cold weather, water companies were inundated with customer calls reporting problems with their water supply. Thames Water received 103,000 calls - 45,000 more than December last year and Severn Trent received 112,000 calls - 400% more than expected. As part of a Government White Paper due out this summer, there are calls to look at how it could be used to protect householders who have their water supply interrupted.

In August 2010, Defra announced that all private sewers and lateral drains would be transferred to the ownership and responsibility of the sewerage companies. This will take place automatically overnight on 1st October 2011.

Opinion:

New homeowners are unlikely to benefit from any changes in the first ten years. Any serious drainage problems will be covered by the NHBC Buildmark warranty. Blockages or problems with drainage are rectified by the house builder during the first two years. This will be an unnecessary additional financial cost to new homeowners. Problems with the water supply pipe are very unlikely with modern homes. The pipe is heavy duty plastic and is required to be buried at a minimum depth of 750mm below finished ground level to protect it from freezing. In addition, all water companies inspect the pipe in the trench before it is covered to ensure compliance.

15 January 2011

Self-build new homes set to increase

The housing minister Grant Shapps hopes to increase the number of self-build new homes by easing planning and regulatory burdens and encourage access to available plots of land. It is thought that most of these would be too small or not commercially viable for general builders, or be local authority land sold off to self-builders in preference to commercial house builders.

A ‘Community Right to Build’ in the Localism Bill will enable people to approve developments wanted by the local community, which would include multiple self-build home schemes. This would by-pass the current planning process.

In Britain, self-builders build between 10,000 - 15,000 new homes each year. This is around 20% of all new homes built. One in three detached houses built each year is a also a self-build.

8 January 2011

Mortgage Interest rates of 7% for those with low equity possible this year.

Some major lenders including NatWest, C&G and Yorkshire Bank are already charging almost 7% for their latest fixed-rate deals for those with a low deposit and low equity and some standard variable rates nearing this mark.

For those with 50% equity, NatWest offers a 5 year fixed-rate of 3.75%, rising to 4.19% for 40% equity, 5.29% for 25% and 6.89% for 20% equity or less.

Home owners are being warned to budget for the worse case as interest rates are forecast to rise this year. Many lenders may pass on higher rate rises (0.25% above base rise) as they try to improve their balance sheets.

5 January 2011

Lower fuel bills by 30% or more and reduce C02 emissions by 50%

Air source heat pump technology could lower fuel bills by at least 30% and reduce Co2 emissions by 50%. Ecodan® advanced heating technology removes the heat from the outside air and uses it to heat your home and hot water.

Surprisingly it can still deliver the heating required, even when the outside air temperature is -20ºC. The system is automatically regulated to ensure that you never use more energy than you need at any given time, making this one of the most efficient ways to heat your home and hot water. The system can be installed in as little as two days by a qualified plumber and as it uses free energy fromt he outside air, it is classified as a renewable energy source. If installed by a registered MCS installer it may qualify for grant funding under the BERR’s Low Carbon Building Programme.

For more information on ECODAN visit www.mitsubishielectric.co.uk/heating

or call Allied Cooling Services (ACS) on 0800 0432197

24 March 2011

First-time buyer mortgages now available for those with a 10% deposit.

Major lenders such as Nat West, C&G, HSBC, Santander and Halifax all now have mortgages available to those with a deposit of just 10%.

22 March 2011

Zero-carbon standards increase price of new homes

The Communities and Local Government has calculated that complying with the Building Regulations zero-carbon standards, will add around £42,770 to the average cost of building a new four bedroom home. The new regulations come into force for all new homes built from 2016. This could make new homes unaffordable and poor value when compared to existing pre 2016 residential property.

11 March 2011

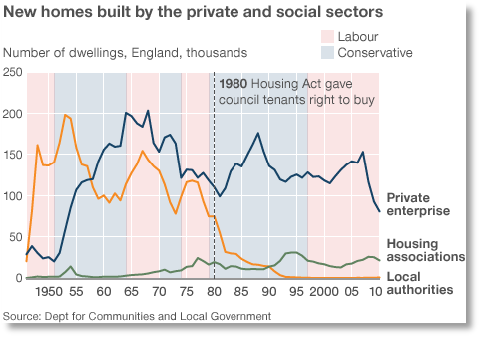

Housing starts running at all time lows

In the 2009/10 12 month period just 87,690 new homes were started, down from 183,360 in 2005/06.

| Micro Homes |

| Studio Apartments |

| Apartments |

| Townhouses |

| Mews Houses |

| Terraced Houses |

| Detached Houses |

| Buying an apartment |

| Leasehold Property |

| Considerations when buying a flat |

| Retirement developments |

| Part exchanging |

| New homes can be bad for your health |

| Why buyers avoid new homes |

| Condensing boilers |

| Brownfield land |

| Consumer Code For Home Builders |

| Consumer Code Dispute Resolution |

| Claiming Compensation - Adjudication Scheme |

| Timber frame new homes |

| Timber frame - what you need to know |

| Quality issues with timber frame homes |

| Fire and timber frame new homes |

| What the NHBC does |

| Tricks of the showhome |

| Sales advisors and sales centres |

| New stamp duty calculator |

| Scotland LBTT calculator |

| Removals and moving home |

| Packing and planning the move |

| Checklist for change of address |

| Choosing a mortgage |

| Avoiding mortgage refusal |

| Rules for new home mortgages |

| Help to Buy |

| First Buy |

| New Buy |

| Best Buys |

| Home Insurance |

| How to save on home insurance |

| Home insurance policy conditions |

| Flood insurance claim |

| Renting do's and don'ts |

| Section 106 Agreements |

| Community Infrastructure Levy 2010 |

| Snagging and Quality |

| Why do new homes have defects |

| Professional snagging |

| Snagging research |

| DIY snagging your new home |

| SNAGGING DEFECT PHOTOGRAPHS |

| External DIY snaglist |

| Internal DIY snaglist |

| External snagging defect photo slideshow |

| Internal snagging defect photo slideshow |

| External snagging defects from new homes |

| Who are the best house builders |

| The worst house builders |

| Builder's end of year figures |

| Finding a new home |

| HBF customer satisfaction survey results |

| NHBC awards league table |

| Job Vacancies |

| Persimmon Homes |

| Taylor Wimpey Homes |

| Barratt Homes |

| Bellway Homes |

| Redrow Homes |

| Bovis Homes |

| Berkeley Homes |

| Linden Homes |

| Crest Homes |

| Miller Homes |

| Bloor Homes |

| Taylor Wimpey on BBC Watchdog |

| New home customer satisfaction surveys |

| HBF New home survey results |

| HBF House builder star rating |

| Site Manager |

| Regional Managing Director 1 |

| Regional Managing Director 2 |

| Executive Chairman 1 |

| Executive Chairman final letter |

| NHBC warranty claim |

| Subject Access Request |

| New Home Blog |

| New Home News |

| Latest news |

| News 2011 |

| News 2010 |

| News 2008 |

| News 2007 |

| News 2006 |