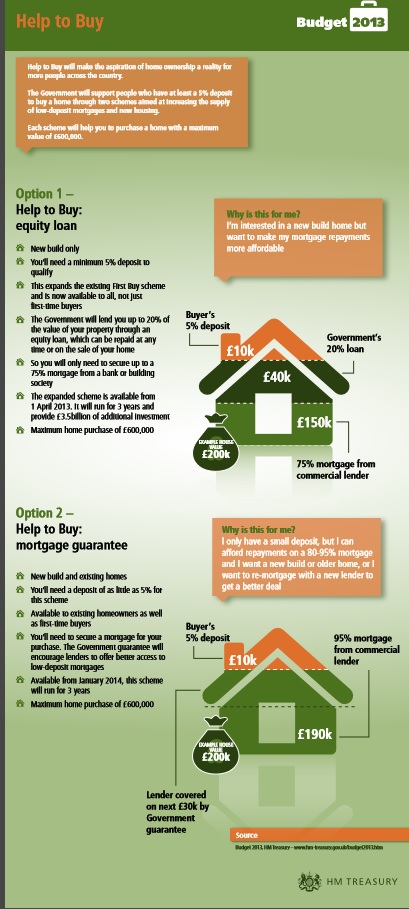

The government equity loan is available on any new home valued at less than £600,000. The government equity loan can be repaid at any time or when the home is sold in the same way as FirstBuy.

Considerations:

New Home Prices:

Carefully examine the builder's advertised prices. Many house builders will prominently list the 80% value as a price, making their new homes appear a bargain. However, be sure to add back the government 20% shared-equity loan and the overall price will probably be a great deal more than a similar previously-owned home on the local property market. It is better to own 100% of a realistically priced home with a 95% mortgage, than 80% of an overpriced brand new home, with two loans to repay, whilst only actually owning 80% of the equity.

Stamp duty:

You will pay stamp duty on 100% of the new home whilst only owning 80%.

Stamp Duty on Shared equity rules.

Equity loan fees:

After year 5, a fee of 1.75% of the loan is due. This fee increases by RPI inflation plus 1% each year. It could end up being more than the mortgage payment on your share of the property. In addition, you will have to pay fees (currently £157 administration fee plus another £115 if the whole loan is not repaid) as well as your own legal fees if you decide to pay off all or part of the government equity loan. None of the fees count towards repaying the loan.

Help to Buy: Mortgage Guarantee

Now there is no longer a need to buy a new-build home to qualify for a 95% mortgage and get on the housing ladder! The NewBuy government mortgage guarantee scheme is now being extended to all properties, not just new homes. Originally proposed to run for three years from January 2014, the scheme has now been brought forward and is available from 7 October 2013. Help-To-Buy mortgage guarantee scheme outline.

To qualify buyers need a deposit of at least 5% but less than 20%. The government will then underwrite a portion of the home loan for lenders, giving buyers a greater access to mortgages, even those with a small deposit. It will provide lenders with the option to purchase a government guarantee that compensates them for a portion (80%) of their losses in the event of foreclosure. The government will charge a commercial fee for the provision of the guarantee which will be valid for seven years.

The scheme exposes the UK taxpayer to a potential liabilities of £130bn with people buying both new homes and older properties with small deposits likely to be most at risk of repossession. The mortgage indemnity is provided for the lender not the home buyer and it does not change the borrower's responsibility or liability to repay the mortgage in any way.

The government guarantee should encourage lenders to offer better access to mortgages for buyers who only have a small 5% deposit. Whilst the scheme does not cost borrowers anything in theory, it will mean, as with NewBuy, that borrowers are charged higher interest rates and fees for a Help To Buy mortgage as the government will be charging lenders for this safeguard.

Under the new scheme buyers must be able to put down a 5% deposit and can then borrow up to 20% of the value of the property, (maximum £120,000) interest-free for the first five years. After 5 years the loan will attract a fee of 1.75%, which will rise each year by the RPI inflation plus 1%.

Help To Buy: Equity Loan

'Help to Buy' was introduced in the 2013 Budget and from 1st April 2013, all new home buyers can take "advantage" of a £3.5bn equity loan scheme from the government, similar to the FirstBuy scheme. The treasury estimates that the scheme will help up to 74,000 new home buyers.