© 2006 - 2023 brand-newhomes.co.uk - All rights reserved

Latest New Home News

15 May 2011

Halifax says house prices fall again in April

According to the Halifax, house prices fell 1.4% month on month in April. This represents a 5% fall over the past year and a 20% collapse since the 2007 market peak. An RICS survey shows a fall in prices for the tenth month in a row. With inflation expected to peak at 5%, interest rates are expected to rise to 1% by the end of this year. Most commentators believe house prices have further to fall as the house price/earnings ratio for first time buyers is 4.3 - double the low during the mid 1990’s.

9 May 2011

Councils using planning system to generate extra revenue

Some local authorities are using Section 106 of the Town and Country Planning Act 1990 to raise revenues by demanding cash payments in return for granting planning permission. Section 106 was originally designed to allow councils to charge for planning gains, to ensure developers of large residential schemes and supermarkets build affordable housing, schools and roads etc. However it is now increasingly being aimed at self-builders, individuals building extensions and small developers building one or two houses. Amounts vary, but recent reports indicate that the charges can be as high as 60% on small schemes.

Eric Pickles the Communities Secretary has vowed to intervene to stop the practice, which he says is a “tax on aspiration”. Until the regulations are amended, he is urging anyone confronted with these charges to use their right to appeal. An aide said, “it was never meant to apply to small developments, especially on domestic property”

Councils demanding money in return for planning permission include Bournemouth Borough Council and Three Rivers District Council in Hertfordshire. Three Rivers intend to charge a rate per square metre on a rising scale between £290 and £1000, depending on the neighbourhood. Purbeck District Council is asking for more than £7,000 in return for planning permission for three flats, one above a shop in Swanage. In Northumberland, another county council was seeking £1,600 for planning to convert a house back into two flats as it had previously been.

Any Section 106 charge or agreement must be directly related to the proposed development local infrastructure assessments which should be undertaken when councils consider planning applications.

The current charges could be in response to the Community Infrastructure Levy. This empowers local authorities to charge on most types of development in their area. However local they are not required to adopt CIL and some will choose not to, due to the administrative burden in setting up and running the Levy and that many Councils consider can currently achieve the same outcome through the use of Section 106 Agreements.

By 2014 Section 106 payments will only be used for affordable housing with everything else being funded under the new Community Infrastructure Levy, with development under 100 square metres being exempted.

6th May 2011

House prices continue to fall says Nationwide

Nationwide’s latest house price index reveals house prices fell 0.2% in April. This brings the average UK house price to £165,509. House prices are now 1.3% lower than in the comparable period of 2010.

2 May 2011

Public opinion suggest house prices have further to fall

According to Findaproperty.com, 42% of people surveyed believe house prices will fall further in 2011, compared to just 11% who favour a rise. A lack of mortgage availability, high unemployment, rising inflation and falling real incomes all adding to the general downward pressure on the housing market. The Halifax research now shows it is cheaper to buy a house than to rent one.

27 April 2011

House builders confirm new homes upturn

Persimmon Homes has recently confirmed that new sales reservations are up 12% on the same period last year. Earlier the company had reported an almost 100% increase in pre tax profits in 2010, due to a 10% increase in revenues for the year.

Meanwhile competitor Taylor Wimpey described market conditions as “resilient” reporting a forward order book of 5681 new homes up 21% since the beginning of the year.

16 April 2011

Payment protection system launched for homeowners.

Bondpay is a newly launched service that has been introduced to give everybody involved in home improvement work peace of mind. It is for both homeowners who don't want to be ripped-off and for contractors who want to be paid in full quickly once the work is completed. It has been likened to a kind of PayPal for building work and operates in much the same way. It is backed by Trustmark and registered with both the FSA and HMRC.

It has been set up to take away the risk and protect householders paying to have work done to their home. Using this method means that no advance payments are made to the contractor. However you are required to pay the full amount of the work into the Bondpay account before work starts. The money is held in a secure insurance bonded account. If the contractor fails to fully finish the work Bondpay will sort it all out and may even add to the fund to get the work completed. When the work is completed Bondpay even provide a warranty, protecting you for the next 12 months for no additional cost.

The Bondpay scheme is entirely free for the homeowner. www.bondpay.co.uk

11 April 2011

Lenders pursuing borrowers with arrears

Recent courtroom statistics suggest that lenders are increasing efforts to pursue borrowers who are in arrears with their mortgage. Thanks to government intervention in early 2009, lenders permitted arrears to increase and held back from repossessing homes, resulting in fewer repossessions than had been forecast. In early 2007, 127,000 mortgages were more than 3 months behind with payments and 15,300 were more than 12 months behind. Today the figures are 239,000 and 62,300 – a substantial increase from 2007. “Lenders appear to be operating on the basis the recession is over and it is business as usual” says lawyer Daniella Lipszyc of Ultimate Law. There were 17,800 repossession actions issued in England and Wales in the last quarter of 2010.

6 April 2011

The Government has clarified details for the 2016 Zero Carbon policy for new homes. The zero carbon definition includes only emissions covered by Building Regulations such as heating, hot water, building services and lighting. Emissions from cooking and electrical appliances such as computers and televisions will not be included as part of the policy.

4 April 2011

Slight increase in new home starts

Recently released data from the NHBC indicates that 26,600 new homes were started in the UK in the three months January to March 2011. This is a 1% increase on the same period last year. In March alone, over 10,000 new homes were started, the highest level since September 2010. The statistics also show that 105,700 new homes were started in the UK in the last 12 months compared to 94,500 for the previous year.

29 March 2011

Budget 2011 measures to help house builders

A number of measures to help the UK house building industry were included in the 2011 Budget statement. Intentions to deregulate the planning system to make it easier to convert old office space into new homes - a presumption in favour of sustainable development - reforms to stamp duty land tax for bulk purchases on new residential property and the acceleration of the supply of surplus public sector land on a “build now pay later” basis.

These are in addition to the announcement of the first buy scheme aiming to help up to 10,000 first-time buyers buy a new home over the next two years. (see below)

For more on the Budget and new homes www.communities.gov.uk

28 March 2011

New £250 million First Buy scheme launched

The recent Budget announced a new £250 million fund to help around 10,000 first-time buyers get on the property ladder. The First Buy scheme will offer loans of up to 20% of the property value of new-build homes helping those without sufficient funds for a deposit.

Buyers will still need a 5% deposit however, with the scheme paying up to 20% of the purchase price interest free for the first five years and at a “low interest” thereafter. The loan will be funded half by the taxpayer and half by the house builder.

Opinion: This is a rehash of Labour’s Homebuy scheme. Since most of the national house builders already offer deposit paid, shared equity, or low cost loans this scheme is more likely to benefit house builders rather than the first-time buyers it is presumably aimed at. A better use for £250 million would be to build more low-cost homes for the rented sector.

19 July 2011

Stamp Duty Land Tax rates lower for multiple purchases

Buying several new residential properties at the same time will reduce the rate of stamp duty land tax inured after the Royal Assent (expected 16 December 2011) to the Finance Act 2011. This is likely to benefit buy-to-let investors as the rate of stamp duty land tax applied will be based on an average price of the properties, rather than the rate for each individual property price.

For more: How to save Stamp Duty

15 July 2011

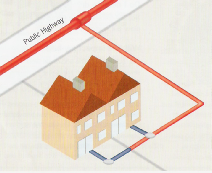

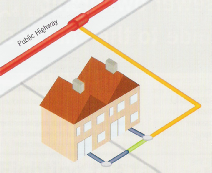

Water companies notify customers of change of ownership of private sewers

All water companies are writing to their customers to inform them of the change of ownership of private sewers that is due to take place on 1st October 2011. Mentioned in the notification is the extra charge of between £3 and £14 a year (equivalent to an increase of 7% on the average bill) which will be added to bills.

Homeowners can appeal under Section 105B of the Water Industry (Schemes for Adoption of Private Sewers) Regulations 2011.

PRIVATE SEWER

PRIVATE DRAIN

LATERAL DRAIN

PUBLIC SEWER

Before the changes

After 1st October 2011

| Micro Homes |

| Studio Apartments |

| Apartments |

| Townhouses |

| Mews Houses |

| Terraced Houses |

| Detached Houses |

| Buying an apartment |

| Leasehold Property |

| Considerations when buying a flat |

| Retirement developments |

| Part exchanging |

| New homes can be bad for your health |

| Why buyers avoid new homes |

| Condensing boilers |

| Brownfield land |

| Consumer Code For Home Builders |

| Consumer Code Dispute Resolution |

| Claiming Compensation - Adjudication Scheme |

| Timber frame new homes |

| Timber frame - what you need to know |

| Quality issues with timber frame homes |

| Fire and timber frame new homes |

| What the NHBC does |

| Tricks of the showhome |

| Sales advisors and sales centres |

| New stamp duty calculator |

| Scotland LBTT calculator |

| Removals and moving home |

| Packing and planning the move |

| Checklist for change of address |

| Choosing a mortgage |

| Avoiding mortgage refusal |

| Rules for new home mortgages |

| Help to Buy |

| First Buy |

| New Buy |

| Best Buys |

| Home Insurance |

| How to save on home insurance |

| Home insurance policy conditions |

| Flood insurance claim |

| Renting do's and don'ts |

| Section 106 Agreements |

| Community Infrastructure Levy 2010 |

| Snagging and Quality |

| Why do new homes have defects |

| Professional snagging |

| Snagging research |

| DIY snagging your new home |

| SNAGGING DEFECT PHOTOGRAPHS |

| External DIY snaglist |

| Internal DIY snaglist |

| External snagging defect photo slideshow |

| Internal snagging defect photo slideshow |

| External snagging defects from new homes |

| Who are the best house builders |

| The worst house builders |

| Builder's end of year figures |

| Finding a new home |

| HBF customer satisfaction survey results |

| NHBC awards league table |

| Job Vacancies |

| Persimmon Homes |

| Taylor Wimpey Homes |

| Barratt Homes |

| Bellway Homes |

| Redrow Homes |

| Bovis Homes |

| Berkeley Homes |

| Linden Homes |

| Crest Homes |

| Miller Homes |

| Bloor Homes |

| Taylor Wimpey on BBC Watchdog |

| New home customer satisfaction surveys |

| HBF New home survey results |

| HBF House builder star rating |

| Site Manager |

| Regional Managing Director 1 |

| Regional Managing Director 2 |

| Executive Chairman 1 |

| Executive Chairman final letter |

| NHBC warranty claim |

| Subject Access Request |

| New Home Blog |

| New Home News |

| Latest news |

| News 2011 |

| News 2010 |

| News 2008 |

| News 2007 |

| News 2006 |