Scotland - Land and Buildings Transaction Tax Calculator

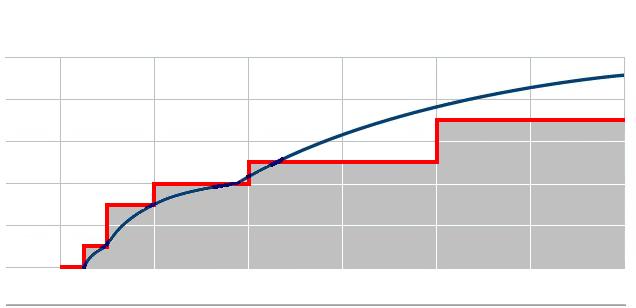

Scotland announced proposed changes to the way it collects property transaction tax before the new UK system. Starting from 15 April 2015, all property transactions in Scotland will be subject to a new property tax called the Land and Buildings Transaction Tax (LBTT). The rates are tiered, as is the case with the rest of the UK from 4 December 2014, but originally, the amount of due on property above £250,000 was to be double the rate paid by the rest of the UK. See graphic below. On homes priced at £325,000 and over the new LBTT charged was even higher than the old “slab structure” method of calculating UK stamp duty it was due to replace. However, on 21 January 2015, the rates and bands were revised. These tax rates and bands remain subject to Parliamentary scrutiny and approval. The Scottish Government will seek Parliament's approval of rate setting orders which will be laid in Parliament in early February 2015.

Use the Land and Buildings Transaction Tax calculator below, to work out how much LBTT will be due before you make an offer to buy.

New Stamp Duty calculator for England and Wales from 4 December 2014

Scotland - LBTT Calculator

10%

Stamp duty effective % rates 2014 - (LBTT in Scotland from 15 April 2015)

0

£3m

£2.5m

£2m

£1.5m

£1m

£500,000

0

2%

4%

6%

8%

Before 4 Dec 2014

| LBTT bands | Rate | Tax |

|---|---|---|

| £0 - £145,000 | 0% | - |

| £145,001 - £250,000 | 2% | - |

| £250,001 - £325,000 | 5% | - |

| £325,000 - £750,000 | 10% | - |

| Above £750,000m | 12% | - |

| Total Land Buildings Transaction Tax payable | - | |

| Micro Homes |

| Studio Apartments |

| Apartments |

| Townhouses |

| Mews Houses |

| Terraced Houses |

| Detached Houses |

| Buying an apartment |

| Leasehold Property |

| Considerations when buying a flat |

| Retirement developments |

| Part exchanging |

| New homes can be bad for your health |

| Why buyers avoid new homes |

| Condensing boilers |

| Brownfield land |

| Consumer Code Dispute Resolution |

| Claiming Compensation - Adjudication Scheme |

| Tricks of the showhome |

| Sales advisors and sales centres |

| Timber frame new homes |

| Timber frame - what you need to know |

| Quality issues with timber frame homes |

| Fire and timber frame new homes |

| What the NHBC does |

| New stamp duty calculator |

| Scotland LBTT calculator |

| Removals and moving home |

| Packing and planning the move |

| Checklist for change of address |

| Choosing a mortgage |

| Avoiding mortgage refusal |

| Rules for new home mortgages |

| Help to Buy |

| First Buy |

| New Buy |

| Best Buys |

| Home Insurance |

| How to save on home insurance |

| Home insurance policy conditions |

| Flood insurance claim |

| Renting do's and don'ts |

| Section 106 Agreements |

| Community Infrastructure Levy 2010 |

| Snagging and Quality |

| Why do new homes have defects |

| Professional snagging |

| Snagging research |

| DIY snagging your new home |

| SNAGGING DEFECT PHOTOGRAPHS |

| External DIY snaglist |

| Internal DIY snaglist |

| External snagging defect photo slideshow |

| Internal snagging defect photo slideshow |

| External snagging defects from new homes |

| Who are the best house builders |

| The worst house builders |

| Builder's end of year figures |

| Finding a new home |

| HBF customer satisfaction survey results |

| NHBC awards league table |

| Job Vacancies |

| Persimmon Homes |

| Taylor Wimpey Homes |

| Barratt Homes |

| Bellway Homes |

| Redrow Homes |

| Bovis Homes |

| Berkeley Homes |

| Linden Homes |

| Crest Homes |

| Miller Homes |

| Bloor Homes |

| Taylor Wimpey on BBC Watchdog |

| New home customer satisfaction surveys |

| HBF New home survey results |

| HBF House builder star rating |

| Site Manager |

| Regional Managing Director 1 |

| Regional Managing Director 2 |

| Executive Chairman 1 |

| Executive Chairman final letter |

| NHBC warranty claim |

| Subject Access Request |

| New Home Blog |

| New Home News |

| Latest news |

| News 2011 |

| News 2010 |

| News 2008 |

| News 2007 |

| News 2006 |