Beware a housebuilder buying back your house may not be ideal

For many new homebuyers who discover they have serious often structural issues with their home, having the housebuilder offer to buy back the property may seem like a perfect solution. After all it would mean and end to all the stress, an end to the worry that the remedial works will not be done properly and end to safety concerns. There would be no need put their lives on hold in a temporary home whilst the plc housebuilder drags its feet with the works, often taking the house, their home, apart to correct defects often over many months, in some cases many years.

So when a housebuilders offer to buy back the property, something most buyers cannot refuse, no mess, not uncertainty a clean break. So after a short period of reflection it is agreed. But the plc housebuilder is in no rush. It is normal for offers to be run alongside the buy back such as fix the home and a small compensation amount.

Builders like the new homeowners to get invested in the proposal, to relax and start to look for their new home.

It is when the buyer is hooked and desperate to wake up from their new home nightmare that the housebuilder starts to ramp up pressure and "play tough." But at this stage the buyer has much more power than they realise. The housebuilder would never have offered to buy back the home had it not been beneficial giving them more time to sort out the problem(s). It also provides an opportunity to keep the issue quiet, preventing others on the development and the wider public finding out about the defective houses. It might in some cases, even work out cheaper option for the housebuilder, as full repairs may not then be carried out and the cost of alternative accommodation and compensation is saved.

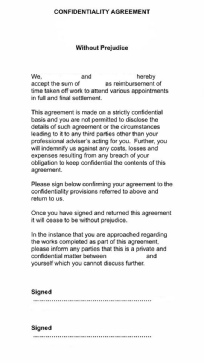

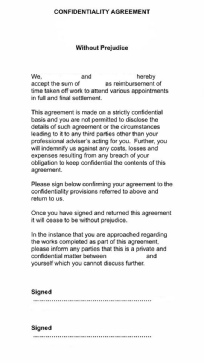

In a final twist at the eleventh hour, buyers are given a buy back agreement to sign which often contains a non-disclosure agreement (NDA)or gagging order. This means legally, on signing, the buyer cannot discuss or reveal the agreement or circumstances surrounding it. It is presented as a "take it or leave it" offer, in effect these large plc housebuilders are bribing and bullying their own customers to accept low offers and sign an NDA even though the deal would, in all probability still gone through had they refused to sign the NDA.

In a final twist at the eleventh hour, buyers are given a buy back agreement to sign which often contains a non-disclosure agreement (NDA)or gagging order. This means legally, on signing, the buyer cannot discuss or reveal the agreement or circumstances surrounding it. It is presented as a "take it or leave it" offer, in effect these large plc housebuilders are bribing and bullying their own customers to accept low offers and sign an NDA even though the deal would, in all probability still gone through had they refused to sign the NDA.

The advice being that anyone offered a buy back should get appoint their own independent solicitor (which the plc housebuilder should pay for) to ensure they are properly and professionally advised.

It is hoped that builder buy-backs referred to as "reversing the sale" in the 2018 New Homes Ombudsman Inquiry report will be one of the options available tor the new homes ombudsman.

In a final twist at the eleventh hour, buyers are given a buy back agreement to sign which often contains a non-disclosure agreement (NDA)or gagging order. This means legally, on signing, the buyer cannot discuss or reveal the agreement or circumstances surrounding it. It is presented as a "take it or leave it" offer, in effect these large plc housebuilders are bribing and bullying their own customers to accept low offers and sign an NDA even though the deal would, in all probability still gone through had they refused to sign the NDA.

In a final twist at the eleventh hour, buyers are given a buy back agreement to sign which often contains a non-disclosure agreement (NDA)or gagging order. This means legally, on signing, the buyer cannot discuss or reveal the agreement or circumstances surrounding it. It is presented as a "take it or leave it" offer, in effect these large plc housebuilders are bribing and bullying their own customers to accept low offers and sign an NDA even though the deal would, in all probability still gone through had they refused to sign the NDA.